Yesterday I intimated that I was revisiting the gold market. I kind of am because I can see a QE3 before the end of the year and am concerned that simply piling into stocks might not protect me at all. So I spent 90minutes in the gym sweating out my thoughts . . . what about that other inflation hedge the international modern art market?

Slate magazine has a series of podcasts dealing with everything from sports through to politics. Today's listen was the Culture Gabfest. I suggest you download it and listen to the second segment (at 13:20) that deals with the art market. Reuters blogger Felix Salmon does a great job of summing up the art market and the fast inflating bubble. Get on his twitter feed. I thought the most telling point he made was in relation to the stage at which the market is reaching. I consider myself a very low level collector, but I hadn't heard about Gehard Richter who is the current darling of the modern art collecting world. He quite perceptively points to two types of bubbles - a) non-speculative and b) speculative. He uses Richter to be part of a speculative bubble which implies you buy to flip ... Sound familiar, this flipping mentality? Wasn't this the anglo-saxon housing markets in the 1997 - 2007 period? Whereas a non-speculative bubble would be where you buy out of fear of missing out. Kind of like a lot of the condo markets in Asia. It's interesting stuff and reminds me of the disconnects we see in the gold market, i.e. the change of the supply and demand situation via the use of ETF's ... compare that to living modern artists who can increase supply or change style etc.

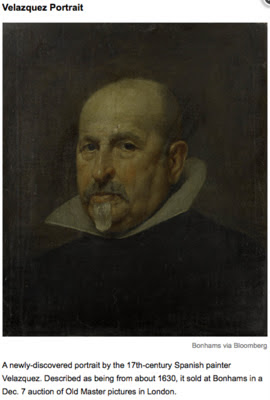

What's my point. Beware of some of these hard asset inflation hedges, especially if you know the supply can be increased easily. I know for example that I like the sound of owning the below rediscovered painting by Velazquez for 3 million pounds in London on 7 Dec 11 because:

1. I know his works because the great galleries of the world have them in their collections

2. It gives me comfort to know I own something that they (or rather Velazquez ) stopped producing

3. Owning works by a painter whose works have sold for more than 50 million dollars for a fraction of the price seems to make sense

Finally I should mention I actually do like some of Richter's works, just as I like Velazquez. But as business is business and inflation is inflation I follow the old trading axiom of using the best, cheapest hedge.

Given Velazquez is a Spanish painter I would normally use that as a lead in to a discussion about Spanish banks, but let;s leave that for another day. I know the Spanish government aren't going to come up with a solution any time soon, so why should I?

The Team time trials start at the Giro d'Italia in 90mins, so I'm off to grab a coffee and grab a copy of todays:

C'mon Greenedge ........

No comments:

Post a Comment