No consumer electronics company was hotter than Sony from the 70's through to the turn of the century. The success was built on continual innovation. My own first experience with Sony was with my father's portable transistor radio that was small enough to fit in his shirt pocket.

Dad's small orange unit came with a big fat ear piece that basically excluded 70% of the population from using it because you needed an ear (this was mono not stereo) big enough for it to fit in. Logically and somewhat famously in 1978 engineer Nobutoshi Kihara put together a unit for Sony co-chairman Akio Morita so he could listen to his favourite music on his frequent transpacific flights. This was the Walkman and it propelled Sony to the top of every consumer's wish list. You could go on about the "Trinitron" TVs, but it was the Walkman which gave Sony it's coolness and the cashflow that eventually led them to acquisitions that they hoped would "wall" their customers in a Sony "fortress" from which they would never venture from. Part of that business plan was Sony Music and to a lesser degree the equivalent investments in movie production and distribution. It all made so much sense, until someone invented the PC and all of a sudden some of the bricks in the wall started to crumble.

Apple now sits on approximately $135 per share in cash and seemingly in the post-Steve Jobs world lacking in inspiration. Building products smaller and more functional with beautiful design aesthetics may not be enough to cut it. The iPad mini is not a solution, it's a problem because it's a lower margin product that is very close to what you get with a full size iPad. That spells cannibalisation to me and although Tim Cook says it will drag in more revenue from new buyers I tend to think it eats away at the business and makes Apple more reliant on the content it can sell (apps plus entertainment). I also think it makes them an easy target for bankers looking for a big M&A ticket such as Apple buying Facebook or Disney. If they do that I don't want to own the stock because what does Tim Cook's team know about merging consumer electronics and entertainment other than how it didn't work for Sony. If they can't innovate then they'll become Microsoft-ish; one big fat dividend play.

So can Apple make sense here? Importantly the millions of smartphones that Apple sells are mostly subsidised by telecom companies keen to lock in consumers who they hope will spend, spend, spend on their voice and data services. The problem with this of course is that increasing competition in hardware means that the telco's may soon be able to take back some margin by reducing the subsidies. Forbes published a very simple but totally valid piece today:

Fundamentals And Technicals Point To $340 Apple Stock Price. The writer Nigram Arora say's that ex-subsidies Apple makes about $30 per share. Therefore he puts it on a multiple of 7x and adds in the cash to value the company fundamentally at about $340. Why 7x? Well it's more art than science and I think is a little harsh, but assume he's about 50% right . . . OK so instead of losing 40% of it's smartphone sales it loses half that amount and then add on the cash. At 7x with cash added in I make that around $387, but at 10x that's $495. Therefore at today's $450 we're in about the middle of the range, meaning a 10% upside. I have said before that $450 - $475 is where I get interested. You make your own judgement, but clearly it's getting closer to where the stock has fundamental value and the innovation option is being priced cheaply.

Last week I mentioned the problems at Monte dei Paschi di Siena (MPS) and thought that this would blow over because the technocrats in Rome and at the ECB just wanted it to go away. That was then and this is now. The Italian election is proving a more effective critic of Monti, Draghi and the other technocrats than I had thought. Now the nitty gritty details of the latest derivatives scandal is coming out suggesting that contracts costing MPS some €700m were "found" by incoming management in a safe. Complete rubbish. The Bank of Italy knew about some these deals two years ago according to the FT. I hate conspiracy theories, but this stinks like the garbage in Naples during a strike. The Government and the ECB have granted MPS €3.9bn in bailout bonds. The real reason this is happening is that the City of Siena owns 30% of the bank and used the dividends and sponsorship of the bank to support a cosy lifestyle. If MPS had gone to the markets to raise the required capital the City would have lost control putting at risk many jobs and much largesse in Southern Tuscany. What politician could afford this to happen?

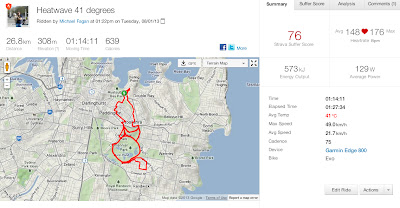

It's been a rainy couple of days in Sydney and I got caught in it yesterday when I got out early for a ride. Riding in the rain in the city is never fun, but it can be a necessary skill. It did allow me to coach my sister in law on the finer points of using brakes in the rain. Thankfully neither of us was on carbon wheels, but even if you have aluminium rims it's worth pumping your brakes to dry the rims before you have to brake. Coming down the short but steep "Gap" run at 12º in the rain means you'll need to sit back and maintain some contact with your braking surface unless you're a pro used to riding in Alps during snow and sleet.

Also it's worth buying a rain jacket that folds up and can be carried in your back pocket. I use an Altura rain jacket that does the job reasonably well.

I wouldn't call it waterproof, it's more shower proof, so you'll get wet in a heavy downpour. The upside is that it does breathe a bit, so you don't get that sauna-like feel other jackets have. I'd like to have a tighter fitting piece, a bit like the Rapha version, but I got it on sale for about $50 leaving me little to complain about.

Ciao!