|

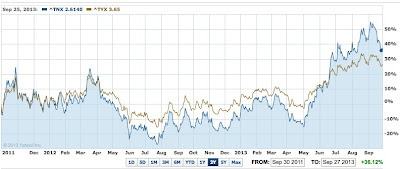

| US 10 and 30yr yield |

- Stabilize income streams, making a less "lumpy" and more predicable earnings profile

- Cut-back on capital usage in order to satisfy Basel III's looming requirements

Now comes a third piece of the puzzle and that is the drop off in volumes/activity especially in the fixed income trading space. This is why data points such as Wells Fargo's laying-off 4,000 employees in mortgage banking (10% of that banks total revenues) matters. Citigroup is doing the same. Remember this all translates to less financial activity and banking is based on "clipping a ticket", thus revenues will be falling. So what can we conclude. The tipping point has already been reached in the cycle, whether the Fed starts tapering in October or January the easy money of refinancing the American housing market has been made.

Next week when the banks start to report I expect there to be some reasonable revenue gaps in their numbers. Analysts have been busy with downgrades ever since 2nd tier Jefferies reported an 85% drop in fixed income revenues in the three months to August compared to the three months to May. Bloomberg are now showing the net income expectations for the US majors to fall by $210m for Citigroup, $128m at Bank of America, $123m at Goldman Sachs and $97m at Morgan Stanley. It's not earth shattering, but it does show that a plateau of sorts has been reached and that when tapering starts the downward trend should continue.

In Australia readers will know that since April I have been suggesting that recent election would bring about increased activity in the infrastructure bond sector. Such predictions fell on deaf ears, but now comes news that the new Treasurer and his finance team are looking into this very notion and hope to bring forward proposals likely to boost demand for said bonds in the coming parliamentary session. I expect there to be various tax breaks to bond holders likely to be in the form of relief on coupons payable etc. If the Australian arms of various major investment banks want to know what they should be devoting resources to I strongly suggest switching some of the equity talent pool to fixed income and also preparing pitch books for Hybrid versions and start booking flights to Canberra. You have been warned. For investors this could be a bonanza of quality yield producing income that should not be avoided.

Japan has recently hit the milestone of one quadrillion Yen in government debt. Even cutting two zeros off that numbers and converting it into US dollars does little to cushion one from the impact of it on a per capita basis.

Japanese Per Capita debt in USD = 1,000,000,000,000,000 / 97.8 x 1/127,650,000 = ~ 80,101

One way to to fix this problem would be to allow future generations, by virtue of population increase share the burden and by "baby-booming" its way out of this trap. Unfortunately the Japanese nation has been reluctant to reproduce at a significant rate and the expectations are now for population decline, meaning that without intervention the debt burden grows on a per capita basis.

Given all this it is expected that the Japanese government will increase their sales tax in order to start repaying some of this money. The theory goes that by printing Yen they will be reflating their way out of some of the debt, but they need to be showing an increase in their revenue base so as to not undermine their efforts in the eyes of the financial markets. This blog's position remains that the Japanese experiment will partially fail as the number of moving parts is just to great to control from a central government. Japan's fate remains precarious at best as its technological lead over its Asian neighbours shrinks leading to a drop off in margins of goods produced. Investors should realise that betting on Toyota etc. is no more or less than a leveraged bet on the demise of the JPY and of growth in the US and Europe.

Hard assets have really performed well since the crisis of 2008. This week you can add to your collection of famous object d'art by buying scarfs warn by George Orwell during the Spanish civil war, including one he was wearing when shot by a fascist sniper.

|

| Eric Blair and his anti-facist scarfs . . . |

Last week I reported to readers that my beloved Cannondale SuperSix Evo had suffered a catastrophic gear failure. At the time I thought the frame itself, though scratched-up and a bit battered would live to fight another day. My optimism has been dashed when local dealer Cheeky Money (Centennial Park, Sydney) declaring it unsafe for riding. The biggest crack can be seen in these pictures.

Given this I asked Cheeky Monkey to investigate a replacement frame. Readers, will know that my experience of Australian Cannondale distributor "CSG" has been less than enchanting. As I said to the excellent team at Cheeky Monkey I wasn't looking to save money by going around them and sourcing the replacement at the lowest possible prices, rather I just wanted some reasonable alternatives and likely delivery times. CSG offered me a choice of two frames, the first was an older 2011-12 Team Liquidgas frame at RRP -20%. The second was black frame of similar vintage at the same price. By the way that discount is no great deal after I found out that Cannondale started a sale of 2013 frames on Friday September 27 across the globe as they look to get rid of old stock ahead of new team colours etc. being introduced for 2014. That probably means that what I was being offered should have been marked down even further. Having said that, price wasn't a deal breaker on its own. When the rep at Cheeky Monkey said . . . "Mike, you're probably not going to like this . . . ", I chose to not get too upset and instead asked the rep to go back to CSG and ask them to try again given that my connections in Europe would be able to supply me with two superior choices at a better price with a lead time of 48hrs! As I have heard nothing at this stage I have given up on CSG. I did commit to Cheeky Monkey as the builder so long as they understood that I was being forced to go around them by circumstance rather than choice. They are a good team and I recommend them. Of course if they decided because of politics between themselves and CSG not to build the bike I would take the parts to Atelier De Velo and no doubt get equally as great service. I hate that I've been put in this position as I strongly want to support my LBS suppliers.

So what alternatives am I looking at? Locally I would have to change brands and I've been investigating what's out there. Bike Lab in Bondi Junction has a choice of alternatives and the boss there Liam walked me through various frames he could get. I liked the idea of this black, yellow and white Colnago C59 but would have to get new bars and cranks to fit the frame:

I also spoke to Liam about the Cipollini RB 800 which aesthetically appealed to me, but Liam suggested I wouldn't like the ride and it was perhaps not for the "larger" bodied rider. It's a pity because the finish on the frames is pretty spectacular:

I also spoke to a Specialized dealer about an S-Works Tarmac SL4. The attractiveness about this offer was that the local distributor had multiple colour choices available in my size and in stock. I've heard good things about Specialized warranty here in Australia and it's somewhat tempting. I like the idea of the special order Vincenzo Nibali Ltd. edition "shark of Messina" themed frame:

|

As for Cannondales it looks like my choices will be the either the new black, green white team frame or the USA themed frame:

I'm leaning towards the red, white and blue theme and setting it up like 2012 US road champion Tim Duggan:

What's not to like? C'mon, we all want a bike with blue bar tape and red hoods, right?

Ciao!