Wednesday, 28 August 2013

Editorial focus, dropped chains and US housing. Time to tango in Paris?

Sydney cycling seems to be getting a little more attention in the media of late. On Sunday a show on one of the commercial channels was all about "the war on our roads". Today after I wrote a short piece on a popular cycling website here I got interviewed by a reporter from the Sydney Morning Herald. It's always difficult to tell what journalists and their editors are putting together, especially in the Herald which has in my view lacked a little bit of editorial focus over the years. I think cycling is such a growth "industry" that the Herald still has a chance to jump on board as The Times did in London and get a free ride on the wave. As an investor it would please me no end if they also thought about the possibilities in terms of revenue streams for this and other recreational orientated past times.

So after struggling through the morning news I managed to get the Cannondale out for a short hop to the beaches followed by lunch in Darlinghurst. Great weather and some happy people helped me put aside nearly getting cleaned up by a garbage truck a matter of only 200m from my house. The truck indicated incorrectly on a roundabout and it was only the pure luck of a second glance that saved me. A pedestrian standing at the crossing acknowledged as much and said so to the truck as it went past her. Oh well, that's the way things go sometime in Sydney.

The guys over at Velocast.cc released a new edition of their tech show today (it's free: http://velocast.cc/portfolio-item/episode15-maintenance-primer). John and Sean went through the basics of bike maintenance including pre-ride checks and discussed what the home mechanic can do themselves. Most of it was familiar to me, though like a lot of riders I'm always a bit reluctant to start pulling apart headsets or remove the chain rings and cranks myself. On Monday I dropped my chain on my Pinarello and somehow it got stuck behind the crank arm and managed to take off the protective patch and give the frame a good scratching. For once I was close to a bike shop I have dealt with and the guys at Velosophy let me sit in while they removed the cranks etc. and put on a new protective patch. It was a $49 charge, with $29 of that for the extra thick frame protector. I should have said I'll give you another 50 if you let me try it myself, but I didn't think fast enough and missed my chance. I reckon bike shops could make a little more cash if they gave you the option of a lesson for these type of repairs. Why not?

On my ride I was thinking about the latest figures from the US housing market and particularly the S&P/Case-Shiller 20-City Composite Home Price Index:

The rate of positive change in the index is slowing and I'm wondering what Fed Chairman Ben Bernanke and his merry crew might be thinking. Surely the sensible central banker must realise that the housing market cannot be supported forever via QE and there must come a time where it has to sink or swim on its own merits. There will be no perfect time to stop the $85bn a month of QE currently in play and the markets will just have to live with it.

The US consumer seems a little happier given all this cash and the Conference Board said its index rose to 81.5 from 80.3 in July, beating expectations for 79.0. Looking forward the expectations index rose to 88.7 from an upwardly revised 86.0. Consumers, however, were less optimistic about their current standing, with the present situation index slipping to 70.7 from July's more than five-year high of 73.6. It's still a reasonable set of numbers and if unemployment trends down you have the Feds window for tapering. Stay long the US dollar and add some GBP.

In some ways it's a pit we don't have Deutsche Marks to invest in anymore. Mind you if we did the exchange rate would be pretty high and as such you might not have got an IFO number such as the one published yesterday. IFO, the index of German business optimism, rose more than expected in August to 107.5 from 106.2 in July. Market analysts had expected 107.0. Thats the fourth rise in a row. Germany's economy expanded 0.7% in the quarter v. the rest of the Eurozone's positive 0.3%. Unemployment still stands at 12.1%, though the amount of hidden unemployment suggests that number is a little soft. I'm getting tempted to spread my portfolio into some French assets even though the current political leadership their looks at best mediocre.

Finally one of my major themes for the year continues to bubble along. Amgen is buying Onyx Pharmaceuticals for $10.4bn. M&A hasn't worked out exactly as I thought, but it's probably helping bankers tread water in the Hamptons over the northern summer. The Pharma-nerds continue to see the industry shrink as the majors gobble up anything with a pipeline. Investors know that I hate the whole space as it's completely beyond me and requires bankers and advisors to be ultra focused in order to achieve stable low volatility returns. As such I advise you to traed lightly and devote only the speculative part of your portfolio into the bio-tech niche.

I'll be back on my bike tomorrow for a longer ride and if you see the Cannondale somewhere around the Eastern suburbs of Sydney don't be afraid to say hello.

Ciao!

Monday, 26 August 2013

Big ideas beget bigger bubbles . . .

Living in the UK for 8 Years until 2005 tossed up many conundrums. I miss the sheer variety of the media, which for all its' faults and foibles was and still is a cornerstone of a great democracy. On broadcasting Channel 4 news has always seemed to me somewhat of a strange exotic bird. It clearly looks at the world from the guilt of the inner city left, but remains just broad enough to have had me as a viewer no matter where I've lived. There are two good reasons to watch senior anchor Jon Snow and his colleagues on a nightly basis. The first is Snow is a convert to the cyclist's cause regularly riding to work and contributing his thoughts on the subject via his daily blog.

The second is that you'll probably get a lot out of senior economics correspondent Faisal Islam and importantly he's spent the last couple of years writing a new book on the economic crisis: Default Line.

I haven't read more than extracts so far but I'm fascinated with the way he tracks down Oldrich Vasicek the creator of the famous mathematical model that is at the core of what happened when the housing bubble burst.

|

| Likable Channel 4 anchor and lefty cyclist Jon Snow . . |

|

| Where it all began |

The importance of Vacicek work is that it led to the creation of the Moodys Analytics which did much of the work of applying the model's pure mathematics to pools of mortgages that were used to leverage the worlds monetary system into the crisis that began in 2007. In very simple terms Vasicek's model was originally aimed at pricing interest rates at a given point in time under the influence of mean reversion. Basically it assumed that when rates got out of line the markets would exploit the arbitrage opportunity to reprice them and make a profit. Why is that important? Well think about bonds and therefore mortgages as a derivative of interest rates. The market prices these through a process of adjusting interest rates applied to a particular instrument by applying a risk factor. Now when that factor is too big, say when a company invents a new widget that makes so much free cash flow that its' probability of default declines then the market buys its bonds knowing that the original interest rate is now out of proportion to the then perceived risk. Obviously the converse is also true. Now think about what happened in the mortgage markets. The banks looked at their mortgage books and started to work out with the available historical data what the likelihood was that a given sample of mortgages might default . . . say mortgages in a particular geography and of a particular size. They thought that if they pooled enough mortgages they could safely define the risk and manage the defaults in such a way as to create an asset that could be priced and traded according to one's appetite for risk. The rest is history and a great reason to buy Faisal Islam's book.

While the world continues to reprice risks life goes on and in much of the world we're coming to the end of the Q2 reporting season. This is how the S&P 500 looks according to data group Factset:

- Of the 487 companies that have reported earnings to date for Q2 2013, 72% have reported earnings above the mean estimate and 53% have reported revenues above the mean estimate.

- Earnings Growth: The blended earnings growth rate for Q2 2013 is 2.1%. If this is the final growth rate for the quarter, it will mark the third consecutive quarter of earnings growth for the index.

- Earnings Revisions: On June 30, the earnings growth rate for Q2 2013 was 0.6%. The Financials sector has seen the largest increase in earnings growth since the end of the quarter. The Telecom Services and Energy sectors have witnessed the largest decreases in earnings growth over this time.

- Earnings Guidance: For Q3 2013, 85 companies have issued negative EPS guidance and 18 companies have issued positive EPS guidance.

- Valuation: The current 12-month forward P/E ratio is 14.1. This P/E ratio is in line with the 10-year average of 14.1.

If the financials reverse course because of money tightening can the rest of the US economy pick up the slack. Remember that the reason the Fed is pumping money into the financials is to supply funds to businesses in need of capital to survive and propser. Judging from these numbers one wonders whether that operation has done anymore than keep banks going and inflate the share market unreasonably. I remain optimistic that the world will grow, but somewhat sanguine on the chances of avoiding shocks during the tapering period.

One potential shock remains in the PIIGS (Portugal, Ireland, Italy and Greece and Spain) where the German Chancellor is once again under pressure to take the lead in respect of a haircut on Greek debt. The problem is that Ireland in its zeal to reform has made it hard for Europe to treat the Greeks as an exception even tough the economy there is very unlike that in Ireland. The Greeks don't have low business tax rates, favorable cultural and structural advantages that allow them to grow their way out of the crisis. That of course is the problem with the EU and in a way brings me back to Vasicek's model. Europe assumed that the default rate amongst countries would converge as the economies came under control of Brussels, but even at the optimistic zenith interest rates in Germany and the north always traded expensively compared to the south. The European arbitrage implicit in academic assumptions of financial asset pricing have not worked because the countries and in some cases the provincial differences are just too great (think north v. south Italy, Scotland v. England, or even east and west Germany etc.). The wholesale printing of money by the ECB in itself cannot and should not make that arbitrage a reality such that a house in Athens or Naples should cost the same as a comparable house in Hamburg or London.

Housing in Spain is going to start clearing its backlog. We know that the ghost towns of the south are being sold starting soon. The Spanish will have to wait another 3+ years, as the Irish did, before the benefits start to accumulate. Their main advantage is that the north will still want to retire in the south and barring global warming Spain will become the Florida of Europe. Maybe events such as the Vuelta will help. I've subscribed to the Eurosport / Velocast podcasts for all the GT's this year and have thought the £50 was money well spent.

You can still subscribe for the Vuelta podcasts for only £15 and get the joy of listening to the guys daily review and preview of the goings on in Spain. I highly recomend it. And for those thinking about a Spanish investment it might just help you take the plunge . . . even if you are only thinking about bying the top of the range Orbea Orca rather than a palatial beach house in the south.

Ciao!

Thursday, 15 August 2013

Is CBA the best bank in the developed world?

Yesterday the Commonwealth Bank of Australia reported and although I've always been cynical about the Australian banks and their performance it's hard to argue with some of the numbers they've put up in the last few years. CBA is up over 30% in the last year and it's been able to produce an RoE of 18.4%. That's impressive given we've been getting used to banks talking about a 10% RoE as being the new norm.

There's no doubt that the current rates cycle in Australia is nearly over and that the bank will have to look forward to the swing up in funding costs and probably an increase in non-performing loans in the next few years, but until then all they have to do is make some prudent funding decisions and they should have a sufficient buffer to do deal with any problems. As with all Australian banks the two areas I'm most interested in are the source and duration of funding and the current shape of the loan portfolio. Here are the charts from the investor presentation that caught my eye:

The current liquidity and source of funds is looking better than previously reported. Remember that the bears have always raised question about the funding of the big 4 Aussie banks loan books based on the fact that so much is sourced overseas. Well that's still a concern, but the shock of 2008 is clearly starting to move them away from this model.

Normally investors might have been happy to get a special dividend as competitor Westpac have recently announced, but management has decided to stay comparatively over capitalised as we get closer to full Basel III implementation. I also seem to remember that you just might be doing shareholders a favour if you see growth opportunities out there while simultaneously running an 18% RoE.

Finally CBA could be the best bank in the world, but that doesn't make it the cheapest. It's trading on a PBR of over 2x.

It's share price is close to all time highs and Australia as a whole still has to face up to a slowing demand from China. If you had it in your portfolio you wouldn't be selling it aggressively, but you may want to keep an eye on it so as to fund another position in your portfolio.

The AUD bounced back above 90 cents partly as response to the iron ore price's continuing upward move and partly because of the recent disclosure of an update by the Australian Treasury. Iron Ore is now back at the $140 per ton level. Nomura estimates that there is an excess 400m tonnes of the steel currently in the system as we go into the seasonally weak period for iron ore. Given this it would seem foolhardy to see the current move as having any real fundamental support and therefore investors in AUD assets need to adopt an appropriate attitude.

I had some notes recently commenting on the weather in Sydney and the high winter temperatures. The cycling opportunities have been everywhere, I just haven't managed to get out of town. There's a few events come up around Sydney including a Wiggle.com.au event in the Hunter Valley that I've entered.

It's a nice area of the world and as long as the mining trucks are off the road it should be a great day. I chose the 120km ride as the 175km is just too much for me. You see I'm almost bored by the time I get to the 100k mark and just want to finish. Of course it will depend on the type of day and the number of metres to climb, but in my case I'm betting I can average around 25kph or so, though I'd like to try for something closer to 30 . . . but you have to be realistic. It's a 7am start unlike the races in Italy which tend to start at 9am, which gives you a chance to digest your breakfast and wake up properly.

If you've never ridden an event like this it can be a little intimidating because you're going to find that riders set off at an absolutely unbelievable pace. I mean some people are just plain nuts. I have no idea if Australia is the same because I haven't ridden that many events. I think this time around I'll carry more solid food and less gels. In addition I'll try and ride on newish tyres because Australian country roads are not at all similar to the billiard table like Swiss roads I first rolled on. The other thing I'll put in a saddle bag will be a patch kit as I'm not sure two tubes will be enough. Obviously therefore I'll also want a couple of CO2 cartridges and a mini pump. The other thing I think that's good to do is to upload the course onto my Garmin 800 so I have a good idea where I am at any moment on the course and importantly where the feed stops are.

The good thing about being a cyclist in Australia is that you're out of the European season, therefore I'm looking forward to getting a chance at the end of season sales from the Euro online retailers. I could really use a new pair of Sidi shoes (the "wire" model would be perfect in size 45.5 if you're wondering).

Ciao!

There's no doubt that the current rates cycle in Australia is nearly over and that the bank will have to look forward to the swing up in funding costs and probably an increase in non-performing loans in the next few years, but until then all they have to do is make some prudent funding decisions and they should have a sufficient buffer to do deal with any problems. As with all Australian banks the two areas I'm most interested in are the source and duration of funding and the current shape of the loan portfolio. Here are the charts from the investor presentation that caught my eye:

Retail sales in Australia have been dismal for some time and therefore one might have suspected that consumer credit arears may have been going up as some sign of economic stress. The above chart though shows a surprisingly benign environment even given the uptrend in the arrears on personal loans . Clearly mortgage stress is also not the problem within the portfolio that many bears on Australia might have thought.

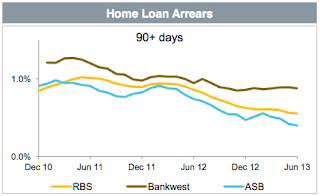

And here's the home loan situation magnified to show the major divisional units. I suspect that the figures for Bankwest might be tracking down as CBA plays with the mix of customers that they direct to the unit; meaning that jumbo mortgages probably get put in one of the other units that might be better placed to monitor a borrowers credit status.

The current liquidity and source of funds is looking better than previously reported. Remember that the bears have always raised question about the funding of the big 4 Aussie banks loan books based on the fact that so much is sourced overseas. Well that's still a concern, but the shock of 2008 is clearly starting to move them away from this model.

Normally investors might have been happy to get a special dividend as competitor Westpac have recently announced, but management has decided to stay comparatively over capitalised as we get closer to full Basel III implementation. I also seem to remember that you just might be doing shareholders a favour if you see growth opportunities out there while simultaneously running an 18% RoE.

Finally CBA could be the best bank in the world, but that doesn't make it the cheapest. It's trading on a PBR of over 2x.

It's share price is close to all time highs and Australia as a whole still has to face up to a slowing demand from China. If you had it in your portfolio you wouldn't be selling it aggressively, but you may want to keep an eye on it so as to fund another position in your portfolio.

The AUD bounced back above 90 cents partly as response to the iron ore price's continuing upward move and partly because of the recent disclosure of an update by the Australian Treasury. Iron Ore is now back at the $140 per ton level. Nomura estimates that there is an excess 400m tonnes of the steel currently in the system as we go into the seasonally weak period for iron ore. Given this it would seem foolhardy to see the current move as having any real fundamental support and therefore investors in AUD assets need to adopt an appropriate attitude.

I had some notes recently commenting on the weather in Sydney and the high winter temperatures. The cycling opportunities have been everywhere, I just haven't managed to get out of town. There's a few events come up around Sydney including a Wiggle.com.au event in the Hunter Valley that I've entered.

It's a nice area of the world and as long as the mining trucks are off the road it should be a great day. I chose the 120km ride as the 175km is just too much for me. You see I'm almost bored by the time I get to the 100k mark and just want to finish. Of course it will depend on the type of day and the number of metres to climb, but in my case I'm betting I can average around 25kph or so, though I'd like to try for something closer to 30 . . . but you have to be realistic. It's a 7am start unlike the races in Italy which tend to start at 9am, which gives you a chance to digest your breakfast and wake up properly.

If you've never ridden an event like this it can be a little intimidating because you're going to find that riders set off at an absolutely unbelievable pace. I mean some people are just plain nuts. I have no idea if Australia is the same because I haven't ridden that many events. I think this time around I'll carry more solid food and less gels. In addition I'll try and ride on newish tyres because Australian country roads are not at all similar to the billiard table like Swiss roads I first rolled on. The other thing I'll put in a saddle bag will be a patch kit as I'm not sure two tubes will be enough. Obviously therefore I'll also want a couple of CO2 cartridges and a mini pump. The other thing I think that's good to do is to upload the course onto my Garmin 800 so I have a good idea where I am at any moment on the course and importantly where the feed stops are.

The good thing about being a cyclist in Australia is that you're out of the European season, therefore I'm looking forward to getting a chance at the end of season sales from the Euro online retailers. I could really use a new pair of Sidi shoes (the "wire" model would be perfect in size 45.5 if you're wondering).

Ciao!

Thursday, 8 August 2013

So be it . . . how not to pick a business, but maybe pick a bike . . .

It's been a long week especially for those in the media. The once secure denezens of the worlds top broadsheets were once again reminded about their career mortatilty when newspapers started to change hands at a rapid pace in the US.

When the New York Times Co. sold the Boston Globe to Red Sox owner and sometime trading guru John Henry for $70m dollars late last week I got to thinking about how quickly value can be destroyed. Some 20 years ago the NYTimes paid $1.1bn for the Globe as it moved to tie up east coast media in some of the richest areas in America. The theory that classifieds would always be king and that these could be easily moved into the electronic world pre-dated the influence of eBay and Craig's List. Looking back at those times it seems again like a lot of so called leaders of business were caught out by the rise of the internet and their only reprieve, the collapse of the dotcom bubble left them grasping at straws.

A couple of days later and the Washington Post Co. sold its' namesake newspaper to Amazon founder Jeff Bezos to concerntrae on its' Kapplan education business which already was providing 55% of the company's revenue. This of course is similar to what Rupert Murdoch did by splitting News Corp into 21st Century Fox (broadcasting) and News Corp (publishing). So the Bezos bet will be leverage his own distribution and marketing genius to get the Washington Post in a position to give a reasonable return in the 21st century. If it works he'll look like a management guru and if it doesn't, well it's only $250m and thats a vanity on the scale of a couple of very high-end corporate jets he can write-off as a bit of fun.

Meanwhile in Australia Fairfax Media which holds the country's leading broadsheets, has seen it's shareprice collapse under the weight of shrinking revenues and tough online competition. This is where the fun and the pain really come into focus because Fairfax has steadfastly refused to move into the 21st century until it's now too late.

Looking at the numbers there's an argument that the stock is cheap at current book value of about 90cents, but they are already making further write-downs in the current financial year . . . so you may as well say that this argument is a moving feast. Then there's the digital potential argument, which is pertinent when you consider what a Jeff Bezos will be trying to do at the Washington Post. Here's the Fairfax digital performance:

Trends are made to be broken. I've extracted just the operating results to show the performance of the business itself. The company reports again on August 22nd and it should be interesting, especially if you're a good analyst and are prepared to ask the board some questions about their strategy in the light of the recent asset sales in the US. The share register for the company has a few Aussie billionaires and some other activists on it. There is M&A potential, but why would you take the risk without the ability to execute . . . unless of course you treat 9the odd masthead as a vanity purchase. No, Investors might be best placed to avoid this unless you believe the general economy will pick up in the 2014 year. Current indications are that this would be foolhardy. Maybe one of the new generation of e-billionaires might fancy some beach property in Australia and a newspaper or two?

I was writing a while back about Banca Monte dei Paschi di Siena and the mess they were in. They recently reported more disastrous numbers once again showing how long the road to recovery will be for many of these banks left with toxic assets and a declining talent base. Last week S&P lowered the ratings on 18 Italian banks as quoting the growth in non-performing loans. The problem now is that these banks are not making loans at anything like the rate required due to the need to raise the supporting capital. The cost of that capital is way too high leaving the banks with no one but the ECB to rely on in the meantime. The US is well ahead of Europe on the road to recovery and should remain the primary focus of the investor at this time.

I was writing a while back about Banca Monte dei Paschi di Siena and the mess they were in. They recently reported more disastrous numbers once again showing how long the road to recovery will be for many of these banks left with toxic assets and a declining talent base. Last week S&P lowered the ratings on 18 Italian banks as quoting the growth in non-performing loans. The problem now is that these banks are not making loans at anything like the rate required due to the need to raise the supporting capital. The cost of that capital is way too high leaving the banks with no one but the ECB to rely on in the meantime. The US is well ahead of Europe on the road to recovery and should remain the primary focus of the investor at this time.

The European cycling season has reached the point of its' final grand tour of the year in Spain. As usual the heat and the mountains will feature prominently. The teams still standing are looking forward to next year as quite a few of them will be looking for new sponsors. Saxo for one will be looking to replace Russian money with someone new. And Euskaltel-Euskadi will probably have to go outside its' traditional basque supporters for cash to compete. If forced to close their doors and become another business casualy on the books of a mediterranean bank it will be a real shame. The team rode the new Orbea Orca at the TdF this year and certainly looked like a beautiful machine to me.

The new Orca represents the new wave of frames that are suitable for mounting either electronic or mechanical shifting group sets. I know I for one wish that my frames had this adaptability as I'd certainly like to give electronic shifting a try without having to butcher my frames with adapters and various work-arounds. Check this out . . .

Subscribe to:

Posts (Atom)