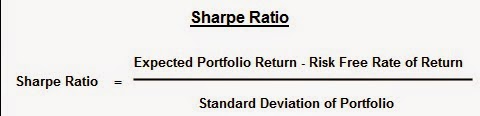

Currency volatility almost inevitably leads to equity market volatility . . .you just can't have the basic pricing unit of your economy "winging around" and not see it flow through into all asset classes. The This is the value trap for investors, because it infects the basic valuation of your investments by virtue of the relationship defined by the sharpe ratio:

The steadiness of the stock market has "bored" investors into believing that they have a better Sharpe ratio than history might otherwise indicate. As such a change in the denominator will come as a shock that should open opportunities.

The UK economy has generally been growing and readers of this blog know that I was a published bull on the economy there as far back as 2012. In fact I had suggested to several Australian investors that they should have taken advantage of the AUD's over-valuation against Sterling in early 2013 to switch into hard assets in the SE of England. In the last six months I've suggested investors should have been switching into Southern European exposures as it was likely that monetary policy in the EU would favour these countries for extended period. Now with Scotland causing consternation amongst UK investors this blog sees further weakness as a buying opportunity. If anything I'd expect London's financial industry to have a field day in the face of asset trading in the any post "Yes" vote and at least a bounce in the face pot a "No" vote. Whatever the case I'd expect an increase in volatility for all UK assets and trading opportunities beyond what we've seen in the past year. Look for the BoE to delay a rate rise in the face of volatility even though we know from recent minutes of the MPC that some see inflation starting to build.

Scotland has a few brands going for it that if fostered correctly should remain the core of their economy for years to come. I know whiskey and smoke salmon seem somewhat at odds with the high-tech 21st century, but as we've seen luxury can be leveraged. Australia on the other hand doesn't really have a lot of iconic brands. France, Italy are the leaders in luxury, but even the US has their own versions. Whatever the reason the brands that do have significant profile here as being Australian classics (think Qantas or R.M.Williams) have all at times been through the proverbial wringer of neglect and mismanagement. When local conglomerate Pacific Brands announced it's intention to sell local "workwear" staples King Gee and Hard Yakka it got me thinking about the nature of branding and the value or lack there of that this notion brings to the value of a company.

The trend in recent years has been to revive, streaming and build brands. The chief proponents in rebranding have been as diverse as LVHM, Richemont, IBM and Apple. Even a mining giant like BHP is doing it after it announced that it was refocusing away from minerals and into energy. It would seem to this blogger that the most successful companies in executing this type of restructuring usually have the following characteristics:

Strong visionary leadership:

Bernard Arnault and Steve Jobs superficially at least would seem to have little in common when it comes to running businesses, but look a little deeper and you'll see similarities. In my mind the most common of these is having an eye for design and an understanding of how this one concept produces value for the consumer and the producer of a product.

When Arnault bought the bankrupt owner of fashion house Christian Dior in the mid-80's he started a chain of events that would lead to formation of uber-luxury group LVMH. The pattern was simple; strip out the low end value eroding product lines and limit expenses on the "highest-end", but media attention grabbing area of haut couture. Then focus on cash generating products that leveraged the core values and name of the company without denigrating the ultimately aspirational and margin enhancing aspect that is the concept of "luxury". He launched the perfume Poison, which although it smelt like bug repellent to me somehow was modern and different enough in itself to relaunch the Dior brand as something for the modern consumer and not just the maker of dresses for an older set of clientele. Arnault, like Gucci bought the brand back under control and stopped licensing out its name for cheap and nasty low end products. When he gained control of Louis Vuitton he adopted a similar strategy only this time recognising that the strength of the signature monogram canvas was being eroded by counterfeiting. Since that time LVHM has been a leading litigant in the war against knock-offs and brand protection.

____________________

An understanding of the core strengths of it's brands

IBM seems to be a strange company to associate with luxury, but it was indeed the epitome of tech luxury from the first golf ball type typewriter right through to room filling main frames. If you had the IBM badge on your business machine, you had the best. What happened though was that IBM, like a fashion house licensed out it's name for clone PC's during the 80's and diluted its brand value. Unlike Gucci, IBM never bought back the real estate it sold and ended up exiting consumer products (with help from Lenovo). Management chose to focus on what IBM had been best at for years and that was business systems. IBM became a consulting powerhouse by keeping only the highest end businesses and with that bought back the margin and management focus that ad almost slipped out of it's grasp.

Steve Jobs understood branding in the same way as IBM. For Jobs, the omnipresent control-freak the Apple brand had lost its cache under John Scully who had begun to investigate licensing out the core operating system to clone manufacturers. When Jobs got back in charge of Apple he killed off the clones and introduced a design "ethic" that has survived his death. That first iMac with the ""bondi blue" translucent case may not have been the fastest computer on the market, but it was the best looking and it was something you didn't have to hide in a nook.

Fiscal targeting

All the design in the world can't help you unless you have some kind of fiscal target. In luxury that usually means margin. Margin is what protects a business and gives it flexibility in bad times. It requires a careful balancing of manufacturing, logistics and supply. Ferrari famously limits production in the knowledge that you might pay more for a "thing" if you know you're not going to see 100 others pass you by on your commute to work. Apple has Tim Cook, logistics genius, because it knows that in consumer electronics the race to the bottom can kill you. As far manufacturing goes, the audacious raid by LVMH on Hermes at the height of the global economic meltdown was as much about acquiring the skilled craftsmen of houses leather works as it was about brand ownership in itself.

Coca-Cola my have been the most egalitarian brand the world had ever seen, but that didn't stop them trying to reinvent themselves with the disaster that became "New Coke". Younger readers may not remember the decision from the Atlanta based behemoth to almost overnight throw out a product that was a brand leader without any real long term fiscal goals. One could understand the move if the company had credible future plans beyond what become little more than the equivalent of a crazy use car salesmen blowing up cars in his lot in an effort to create new "buzz" about his business.

Significant "edge" or "leadership" in at least one area of design or skill

Coke tells us once you have leadership you need to wall it off and protect it, much like LVMH protect Louis Vuitton and it's other brands by prosecuting counterfeiters everywhere. If you can't protect your product you need to make it very expensive for others to jump on into your market. This is where I return to Australia and in particular the current CEO and board of Qantas.

The one thing the world knows about Qantas is that its aircraft didn't used to have malfunctions. That seen in the Tom Cruise, Dustin Hoffman film "Rainman" where Hoffman's charter refuses to fly on anything other than a Qantas plane said it all. The problem of course was that expansion means you can't control the product in the same way. Take Starbucks . . . the quality suffered as the product expanded. New machines replaced the old espresso machines because they were quicker, rather than better. That was expensive and those "auto" cappuccino generators eventually got tossed away when the company started to look shaky. Qantas had a virtual "Coke-like" monopoly of the Australian domestic market after its main rival collapsed. Internationally the airline was being challenged by Asian flag carriers who offered newer fleets and a better service ethos . . . but Qantas had safety and in reality was small enough even in the 90's to nimbly move to upgrade and expand it's fleet to at least match the Asian carriers; so what changed? Well the Qantas domestic margins were too much of a draw to other carriers and logistics businesses. The choice was easy, protect the income line (market share) or the bottom line (Margin). The CEO and the board decided it was better to maintain market share domestically as they belied that this would protect their under siege international operations. The line in the sand of 60-odd% domestically became a race to the bottom. Insanely (to some) to cover up the race Qantas started Jet Star in an effort to have its cake and eat it too. The theory was that Qantas would be the premium business airline and Jet Star would, like a souther hemisphere Ryanair hoover up the tourist dollars. The problem was that the competition was equal to the task and margins became so thin that the profit line became almost like punting jet fuel futures. It didn't help that the cost cutting that the company put in place saw the fleet age and encounter several embarrassing mishaps that undercut the long cultivated record for reliability.

________________

Last week I heard about the death of another design genius Giovanni 'Nanni" Pinarello. Readers of this blog will know my fond memories of rediscovering bike riding after being presented with my Pinarello Dogma 60.1 at the Pinarello family HQ in Treviso Italy.

Nanni was 88 at the time, but his daughter told me he still came to the retail outlet inside the walls of the city everyday. He liked to supervise his staff and especially liked to assist in fitting the bikes. I'm not sure what the dimunitive Nanni thought of my 95kg's perched on top of the carbon fibre racing frame, but he smiled and seemed happy and engaged even if the mechanic doing most of the work begged him to leave it to him. The attention to detail that day in Treviso still impresses me and makes me understand the dedication needed to run a brand successfully. Nanni was 92 when he passed away and I'll bet a Qantas flight to Melbourne he still would have been shuffling into the shop and lecturing the staff on the presentation of the products right up until the day he died.

Ciao!

No comments:

Post a Comment